You must establish credit in order to buy a house. You need to know what your credit score is and if its below average take steps to improve it before applying for a mortgage.

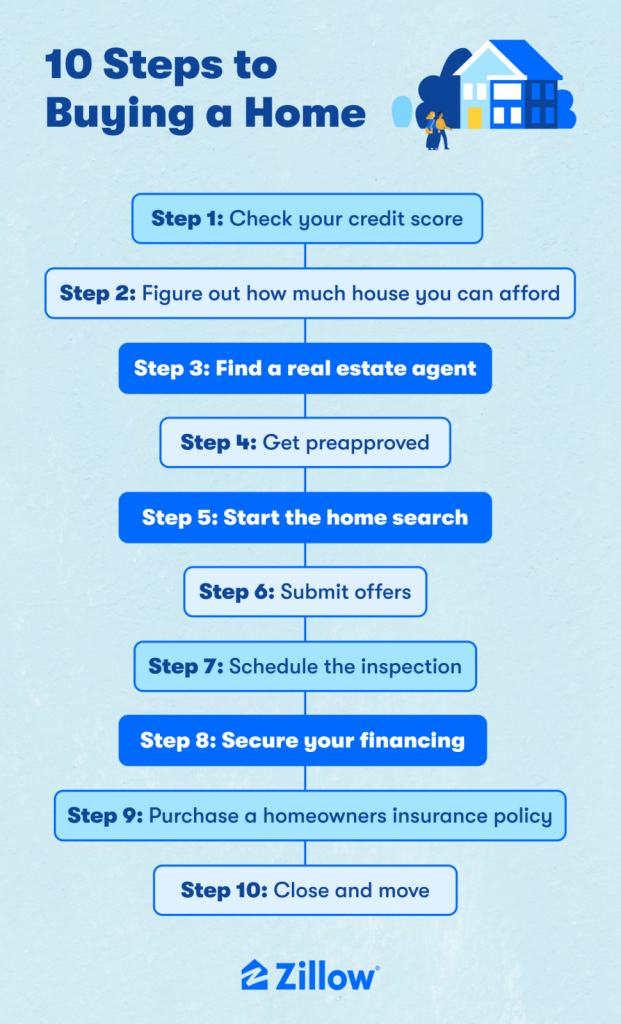

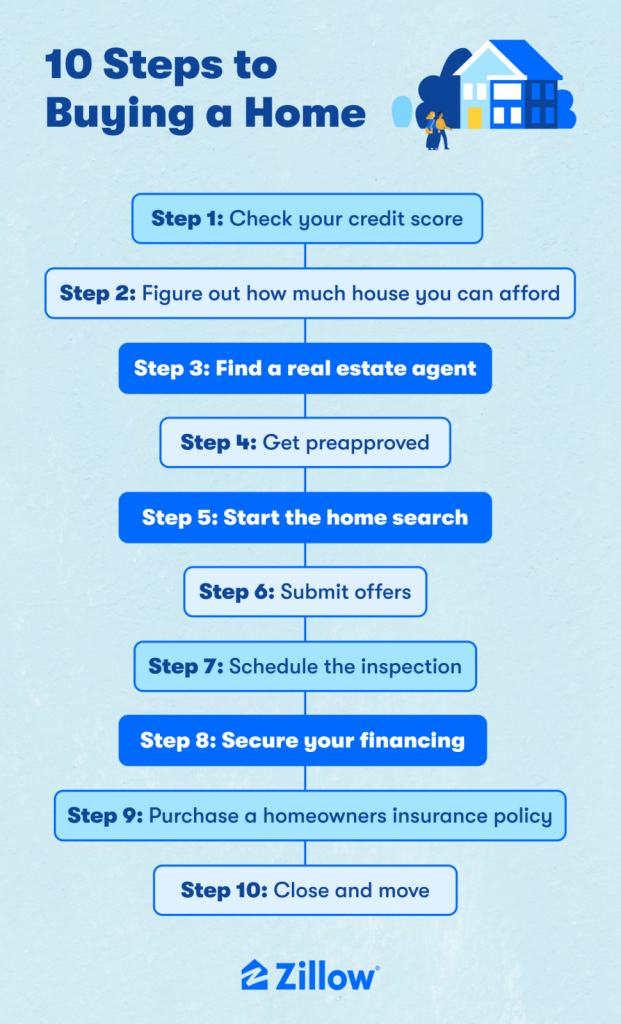

10 Most Important Steps To Buying A House Zillow

FHA loans require two tradelines.

. What Credit Score Is Needed to Buy a House. Gain access to utilities. 9 You must establish credit in order to buy a house A True B False 10 If you are.

When you repay your credit card bill on time it adds positive payment history to your credit report. On FHA loans your credit score is directly tied to the down payment youll be required to make. If your score is below 650 you may be able to get a conventional mortgage with a higher interest rate.

FHA loans allow lenders to use nontraditional credit histories to. You must establish credit in order to buy a house true or false. The higher your credit score the better.

2 Show answers Another question on Computers and Technology. However the minimum credit score requirements vary based on the type. TF you must establish credit in order to buy a house depreciation a decrease or loss in value false TF co-signing a loan is a good way to help a friend or relative upside down When a person owes more on an item like a car or house than it is worth the person is said to be secured upside down on the loan.

For most loan types the credit score needed to buy a house is at least 620. The Best Credit Cards for Building Credit of 2022 CNBC You must put down a minimum deposit of 200 to open a Discover it Secured Credit Card or as much as 2500. Buyers often hesitate about talking to a mortgage company or lender until they find the house they want to make an offer on but theyre actually better off getting that approval before they start house hunting.

Credit scores are based on how youve managed debt in the past and lenders use your score to establish the level of risk you pose as a 21. The minimum credit score need to buy a house can vary based on the type of loan. Get hired for some jobs.

If you use it responsibly that is. If you have a score of 580 or above youll need to make at least a 35 down payment. If you are a victim of identity theft you are only responsible for paying back half of the debt.

As a result your credit score should increase. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages. How to Build Credit Experian.

Take out an insurance policy. That said applying for a credit card right before you buy a house isnt a good idea. According to Experian one of the three major credit bureaus it takes 3 6 months of regular activity for a credit score to be calculated.

This amount is based on the daily meal allowance and. For an FHA loan for example its possible to qualify for a mortgage. You must establish credit in order to buy a house for the first time.

9 you must establish credit in order to buy a house a. Its important that you know your credit score your debt-to-income ratio and have a realistic gauge of your overall financial health before you start the process of buying a home. However a higher score significantly improves your chances of approval as borrowers with scores under 650 tend to.

Credit scores range from 300 which is poor to 850 which is excellent. 9 You must establish credit in order to buy a house A True B False 10 If you are from FINANCE 12345 at Crowder College. In order for a new borrower to establish a credit account you may have to.

Its fine to have more but if you have fewer you wont qualify for a mortgage. No credit score requirement. Like Sasha if you were buying a house you might need to borrow 200000 or 16.

This is great news if youd like to apply for a loan so you can buy a car or home or make another major purchase soon and. You need a score of 580 to get an FHA loan. If its 579 or lower your down payment will need to be at least 10.

With a real preapproval the lender will verify your income documentation and not just check your credit scores he said. Computers and Technology 23062019 0500. When you apply for a credit card a hard inquiry shows up on.

Conventional loans require at least three tradelines any combination of credit cards student loans car loans and so on that have been active within the past 12-24 months. Anything above 700 is considered good. Borrowers without a strong credit record often use FHA mortgages backed by the Federal Housing Administration.

You must establish credit in order to buy a house False If you are a victim of identity theft you are only responsible for paying back half of the debt Paying cash for all purchases Which of the following is NOT a factor in determining a FICO score. Make sure you have several tradelines. In cell b18 enter a formula to calculate the amount budgeted for meals.

You must comply with the lenders requirements when you apply for a mortgage and buying a house will typically require at least a 680 FICO score. The number 650 is probably the number you want to aim for.

Ever Had An Agent Deny To Show You A Home Because You Weren T Pre Approved For A Mortgage It S Not Because They Re Mean Or Preapproved Mortgage Mortgage Pre

What Credit Score Do You Need To Buy A House In 2022

What Credit Score Do You Need To Buy A House In 2022

What Credit Score Do You Need To Buy A House In 2022

The First Time Homebuyer S Timeline Home Buying Buying First Home Home Buying Checklist

8 Things Not To Do In Your Quest To Buy A House Infographic Home Buying Home Buying Tips Home Buying Process

2020 Homebuying Checklist Home Buying Checklist Real Estate Buyers Home Buying

0 comments

Post a Comment